Nasdaq 100 futures are flat this morning, premarket, after the tech-heavy index rose a stable 1.3% yesterday, nearing its report excessive. Against this, the broader S&P 500 index rose “solely” 1%. The Nasdaq is up 20% yr up to now. (The S&P is up 14.5%.)

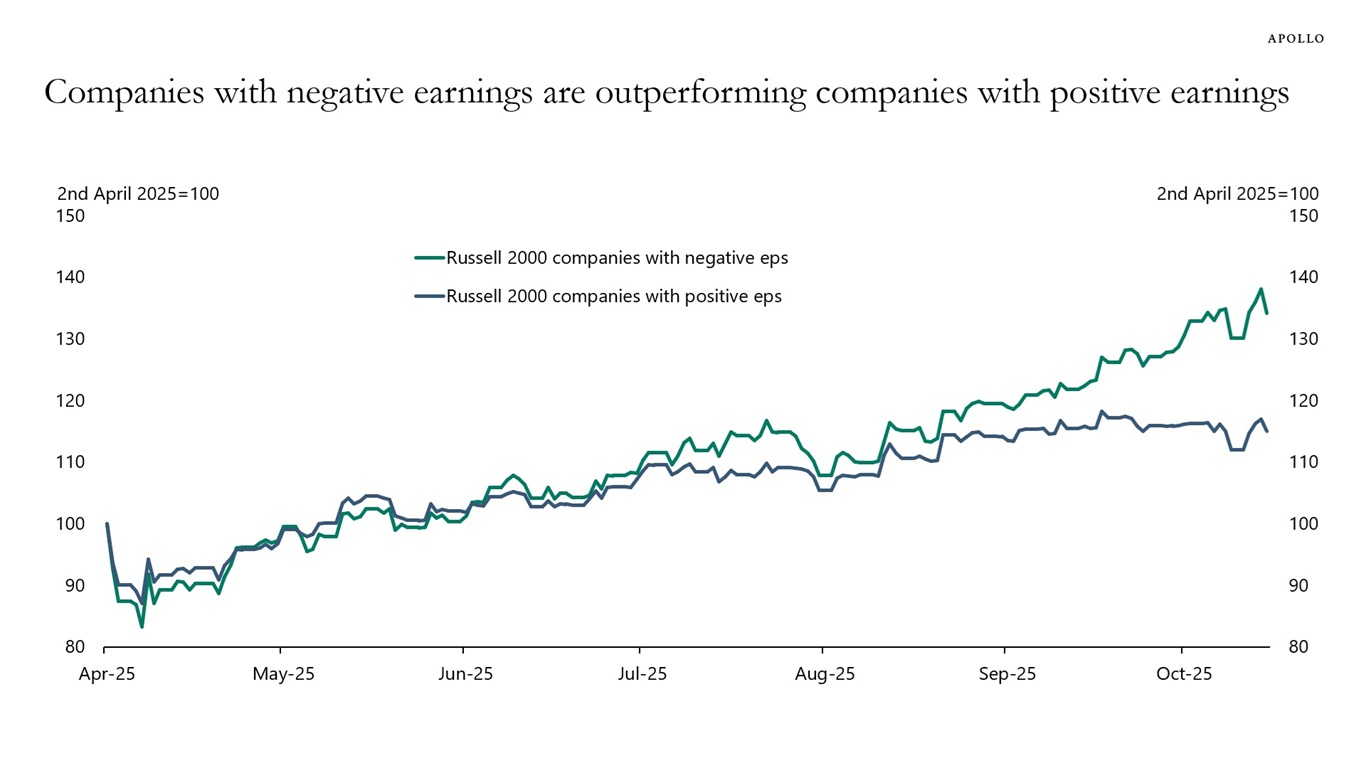

But on Wall Road, analysts are more and more asking whether or not tech shares are in a bubble, and one essential stat retains arising: About 40% of the businesses within the small-cap Russell 2000 index have no earnings or negative earnings, based on Apollo Global Management chief economist Torsten Slok. “One thing exceptional is occurring within the fairness market. Inventory costs of firms with adverse earnings have in current months outperformed inventory costs of firms with constructive earnings,” he stated on his weblog.

Most of these unprofitable firms are tech firms, he informed Fortune.

This quirk was additionally seen by Morgan Stanley chief funding officer Lisa Shalett. “Greater than a 3rd of the Russell 2000 stays unprofitable [and] small-cap firms’ price of capital is effectively above their return on property,” she stated in her most up-to-date weekly observe.

Savita Subramanian and her colleagues at Bank of America are additionally involved. They stated shares had been “frothy to bubbly” in a current observe as a result of the S&P 500 is now “richer” than it was within the yr of the 2000 dotcom bust on 9 of 20 metrics they use to gauge whether or not shares are in bubble territory.

“Of 20 valuation metrics we usually monitor, the S&P 500’s market cap to GDP, value to e book, value to working money stream, and enterprise worth to gross sales have hit new data,” they stated. “The index eclipses its March 2000 metrics on 5 others: Worth to GAAP EPS, median P/E, EV/Ebitda, S&P v. WTI, and S&P v. Russell 2000.”

Nevertheless, context is necessary, they stated: “Historic comparisons are problematic, as immediately’s S&P is increased high quality, asset gentle, much less levered, and many others. However dangers are mounting, and the valuation ground for the S&P 500 is probably going decrease than immediately’s ranges.”

So are tech shares going to crash?

Not if, as is anticipated, the U.S. Federal Reserve continues to make new money cheaper to acquire by way of its program of rate of interest cuts. That’s more likely to gasoline additional capital expenditure in tech, notably as dealmaking within the AI sector stays fierce. (It’s value asking questions in regards to the high quality of that dealmaking: Because the Wall Road Journal notes immediately, AI revenue does not exceed AI capex.)

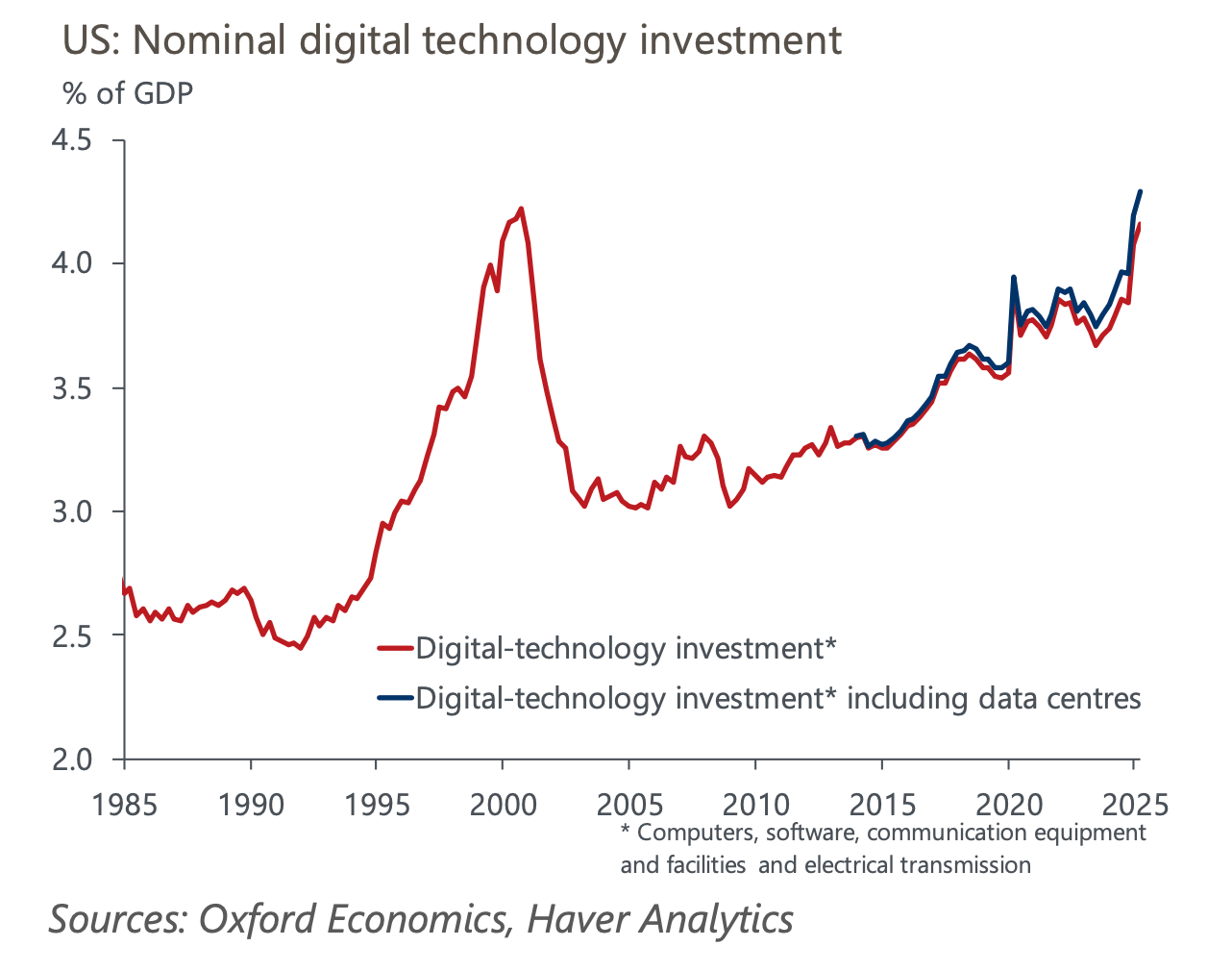

“Our U.S. GDP development forecast of two.3% for 2026 considerably exceeds the consensus estimate of 1.7%. Nevertheless, we assume digital tech funding as a share of GDP received’t enhance additional. If digital tech funding does enhance, then U.S. GDP development could possibly be virtually double the consensus expectation and much surpass development charges of different superior economies,” Ben Could of Oxford Economics stated in a analysis observe. He believes that if tech capex continues to develop, U.S. GDP may hit 3% subsequent yr.

That doesn’t imply that the inventory market is partying prefer it’s 1999, he wrote. “As a result of vital structural shifts over the previous three and a half a long time, the current enhance in tech funding started from a a lot increased level than within the early Nineties. Consequently, there’s no clear motive why surpassing the late Nineties peak within the ratio ought to point out that AI funding is in a bubble. Even when it had been, the bubble may proceed to inflate.”

Right here’s a snapshot of the markets forward of the opening bell in New York this morning:

- S&P 500 futures had been down marginally this morning. The index closed up 1.07% in its final session.

- The STOXX Europe 600 was flat in early buying and selling.

- The U.Okay.’s FTSE 100 was up 0.22% in early buying and selling.

- Japan’s Nikkei 225 was up 0.27%.

- China’s CSI 300 was up 1.53%.

- The South Korea KOSPI was up 0.24%.

- India’s Nifty 50 was up 0.098% earlier than the top of the session.

- Bitcoin was all the way down to $108K.