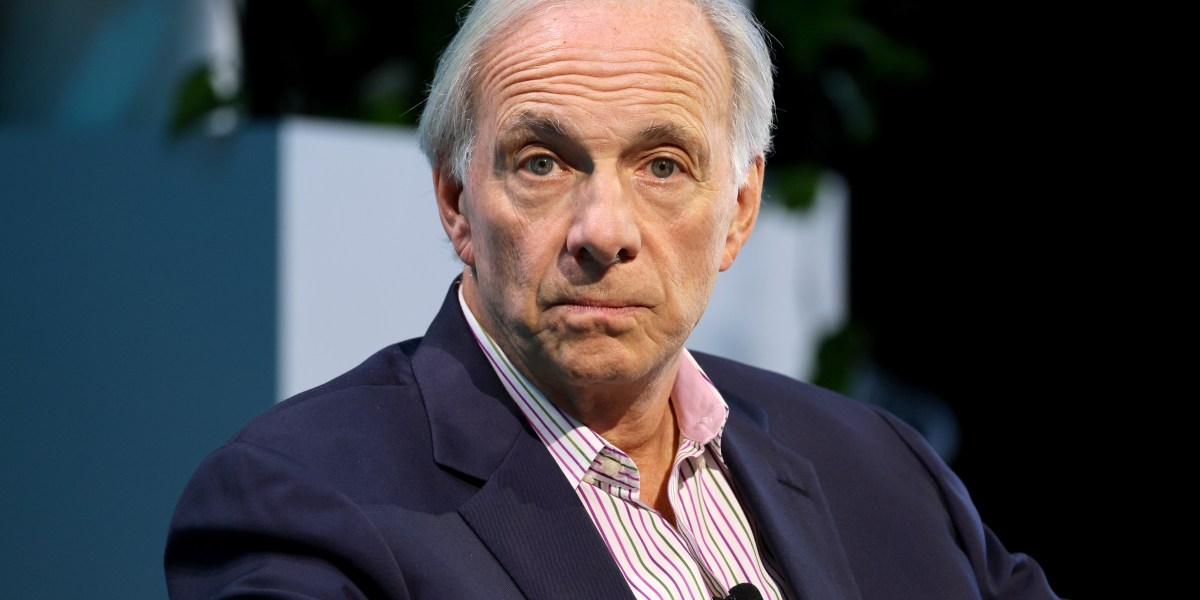

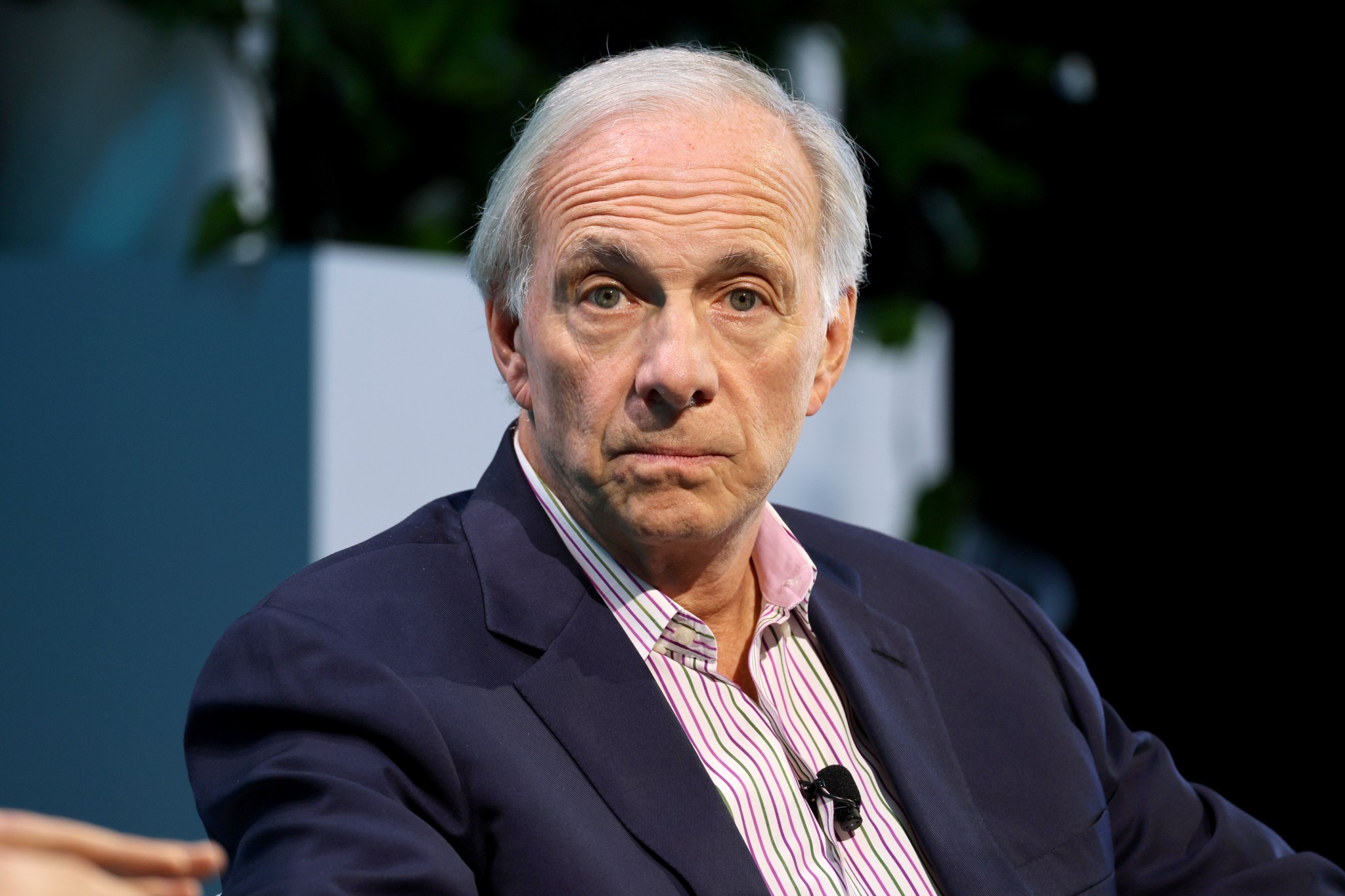

Bridgewater Associates founder Ray Dalio is all the time looking out for the following problem which might derail the economic system. He, like many others, is extraordinarily involved about nationwide debt. He’s additionally conscious of geopolitical battle, restructuring of the financial world order, and likewise the rising tensions inside America itself.

Ought to friction within the U.S. proceed, the hedge fund founder warned people’ potential to “damage one another” has by no means been larger.

He defined: “We’re in wars. There’s a monetary, cash warfare. There’s a know-how warfare, there’s geopolitical wars, and there are extra army wars. And so we now have a civil warfare of some kind which is creating within the U.S. and elsewhere, the place there are irreconcilable variations.”

Chatting with Bloomberg, Dalio stated there are two outcomes for America: Both the nation pulls collectively and rises above, or conflicting sides exert as a lot ache on the opposite as they’ll.

Society might “rise above it and understand that our widespread good goes to necessitate us coping with it in order that what works for most individuals goes to work.” Sadly, this perception might show “somewhat bit idealistic.”

“I’ve to be a sensible particular person,” he continued. “I believe that these conflicts will change into exams of energy by both sides.”

America is extra divided than prior to now. Final 12 months, a Gallup survey discovered 80% of Individuals believed their nation was “drastically divided” on key points, with Republicans barely extra inclined than Democrats to say the nation was united.

Certainly, many buyers shall be accustomed to Dalio’s warnings—the billionaire has lengthy stated that geopolitical tensions might spill into one other international battle. Back in 2023, Dalio warned the probability of a 3rd world warfare had elevated to 50% following Russia’s invasion of Ukraine, and the Israel-Hamas battle.

Whereas naysayers might argue Dalio is the boy who cried wolf, his warning has paid off prior to now. In 2007, Bridgewater started to warn of huge dangers embedded “within the system”—by 2008, a monetary disaster had hit.

Furthermore, whereas Dalio’s warning sounds alarming, additionally it is considerably inevitable: “In historical past we now have to acknowledge that each one orders have come to an finish, after which there’s a brand new order, and there’s a problem. I’ve a precept, in case you fear, you don’t have to fret. And in case you don’t fear, it’s good to fear—in case you fear then you’ll care for what you’re worrying about and [prevent it] from occurring.”

Nationwide debt fears

One in all Dalio’s high fears—and certainly one of many elements he cites for a possible international warfare—is nationwide debt. Like a lot of his friends (Jamie Dimon and Jerome Powell to call a couple of) Dalio is fearful that sooner or later America’s must promote debt will outweigh the market’s urge for food to purchase it.

This may doubtless be prompted by America’s debt-to-GDP ratio turning into much more imbalanced—at the moment it stands at round 125%—at which level debt patrons will demand larger premiums to make sure returns, or will exit the market totally. Both choice leaves the U.S. in a tricky spot, with larger curiosity to pay out or important cutbacks to be made.

This imbalance, what Dalio calls the “debt bomb”, is an financial coronary heart assault ready to occur he argues: “When debt and debt service rise relative to your earnings it’s like plaque within the arteries that then begins to squeeze out the spending.”

The Bridgewater founder added this stress isn’t something new, saying these points cycle repeatedly by way of time—what’s wanted to mitigate its impression is knowing the “trigger and impact” dynamic.

“Each time issues are coming alongside that I had not seen earlier than, I actually wanted to know in the event that they occurred in historical past so I can perceive the mechanics, which is why examine historical past,” he added.