The bull market simply celebrated its third anniversary and high analysts on Wall Road are starting to voice the beforehand unthinkable: is synthetic intelligence (AI), the dynamo powering the nice rally, truly form of dangerous for financial progress? The consensus holds that AI will inevitably ship giant productiveness features and that’s powered offers value tons of of billions of {dollars} right into a throwback, Nineteenth-century model (or late Nineteen Nineties-style) infrastructure growth. This has led to fears of bubble formation, with even Jeff Bezos saying not too long ago it’s “form of an infrastructure bubble,” not one purely pushed by monetary hypothesis, and it’ll repay for years, even generations.

“It appears you may’t go anyplace with out speaking about AI,” in accordance with Aditya Bhave, senior U.S. economist at Bank of America Analysis, whose staff tackled the topic on Friday. “AI: it’s what everyone seems to be speaking about,” they mentioned.

In BofA’s consumer discussions, in accordance with Bhave’s staff, “some of the regularly mentioned subjects is AI and what it means for progress, productiveness, and the labor market.” They concluded that they haven’t discovered proof of AI utilization resulting in job losses, particularly throughout white-collar occupations. “The productiveness story appears to be profitable, at the very least up to now.” Morgan Stanley Wealth Administration’s Lisa Shalett and UBS’s Paul Donovan aren’t so certain.

Lisa Shalett, chief funding officer for MS Wealth Administration, previously told Fortune she was “very involved” about bubbly situations round AI, and reiterated in an October 1 analysis be aware that the rally is in its “seventh inning.” Morgan Stanley’s International Funding Committee flagged three issues on their thoughts because the ballgame nears its finish: challenges in free money circulate progress among the many so-called “hyperscalers,” speculative deal-making and, lastly, “slowing progress in key income segments.”

Paul Donovan, world chief economist for UBS Wealth Administration, wrote on Friday {that a} easy query is haunting markets: “Is AI hurting growth?” He famous “the exuberance” round it, which “must be based mostly on an expectation that investing in the present day will generate larger financial output sooner or later,” and in that sense, AI is unquestionably good for long-term progress. The issue, in different phrases, is nearer to house, in these final two innings Shalett has been worrying about.

Rising debate amongst consultants

Donovan’s evaluation consists of boosts to progress from the now-archetypal knowledge middle resulting in financial exercise from development staff, programmers and so forth, which have helped raise U.S. progress. “However AI doubtlessly lowers present progress by diverting assets,” he mentioned. For instance, he cited analysis by Bloomberg displaying that as regional electrical energy costs are pushed larger by the facility wants of information facilities, the spiking invoice for customers leads to much less cash to spend elsewhere within the economic system. Likewise, energy-intensive companies will face larger prices, too. This dangers “creating a spot within the financial progress story,” Donovan mentioned, as a result of this dynamic may pressure some at present economically productive companies to shut. In different phrases, does the native small enterprise should die so the info middle can dwell?

Morgan Stanley’s Shalett flags a distinct concern, that even the supposedly dynamic new AI-based companies simply aren’t rising so quick proper now. She blames “market saturation or monopolies—as seen in search and digital promoting—and rising competitors,” citing cloud providers, the place new entrants are competing on worth in a battle for market share. She’s additionally nervous about large quantities of enterprise capital flocking to fledgling enterprise fashions, and suggested buyers to rethink their publicity to small-cap and unprofitable tech companies.

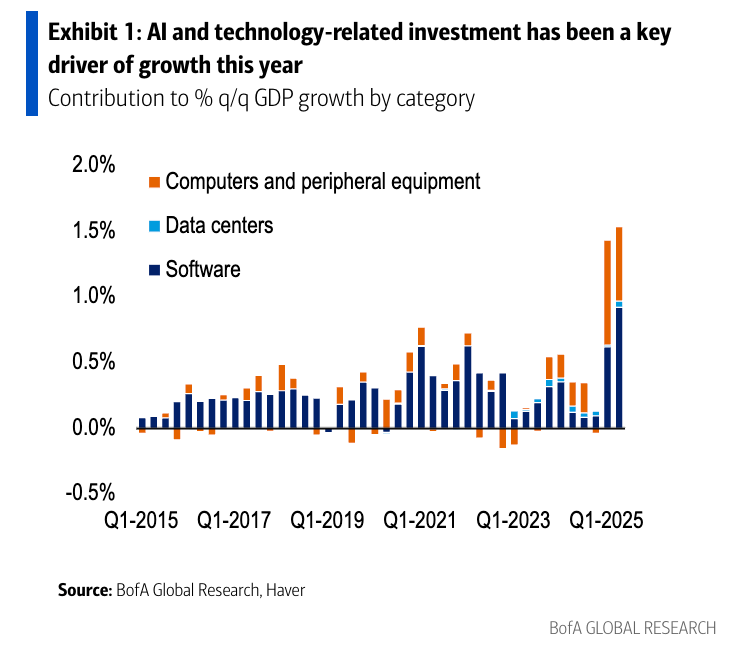

Bhave’s staff is usually extra bullish. Whereas permitting that dangers aren’t off the desk within the medium time period, they argue that for now at the very least, AI seems to be a “web optimistic” for progress. Simply have a look at the GDP figures from the primary half, which shocked even BofA’s comparatively optimistic expectations. The rebound to an annualized price of 1.6% is “significantly resilient contemplating the lacking imports drawback” within the first quarter as a result of Trump tariff shock, which “blurs the image” a bit. Funding in AI is simply an enormous pressure driving the economic system ahead, they are saying.

Bhave’s staff cited senior analyst Vivek Arya, who covers the semiconductors sector, and his bullish name that regardless of issues concerning the medium time period, capex spending will nonetheless energy GDP progress. Arya beforehand instructed Fortune in an interview that he thinks jitters should do with this specific time of yr, the fourth quarter crunch as most companies begin eager about what’s across the bend. Economist Owen Lamont calls it “panic season” in markets and Shalett herself famous the S&P 500 has not too long ago managed to defy the “September curse” of traditionally poor efficiency, delivering an almost 3% acquire.

Arya instructed Fortune that BofA has seen “in prior years proper round this time … individuals get justifiably very nervous about what’s going to be the quantity of spending subsequent yr.” Within the begin of 2025, he added, purchasers anticipated cloud capex to solely develop about 20% or so, however thats been blown out of the water with 50%-60% growth instead. “However now it’s the concern once more for subsequent yr and the yr past that.”

One other voice is former Obama administration economist Jason Furman, on the college at Harvard, who calculated in late September that with out knowledge facilities, these GDP figures would look a bit completely different. Subtracting all that capex leads to a progress of simply 0.1% on an annualized foundation for the primary half of 2025. To Donovan’s level, another productive actions would have taken its place, Furman added: “Absent the AI growth we’d most likely have decrease rates of interest [and] electrical energy costs, thus some extra progress in different sectors. In very tough phrases that would possibly make up about half of what we acquired from the AI growth.” Nonetheless, the query of AI and progress isn’t a simple one.