- The U.S. authorities shutdown has halted federal financial information assortment, leaving traders with out official employment or inflation figures. Regardless of flying blind, markets stay upbeat as shares close to report highs. Gold fell sharply. And Q3 earnings estimates look sturdy, boosted by AI funding.

S&P 500 futures have been up marginally this morning after the index closed flat yesterday, close to its all-time excessive. Markets in each Europe and Asia have been up or flat this morning, too. Gold, the normal safe-haven asset which has gained 55% year-to-date, misplaced 5.3% yesterday—its greatest decline in 5 years.

In different phrases, traders look like shifting from risk-off positions into risk-on mode.

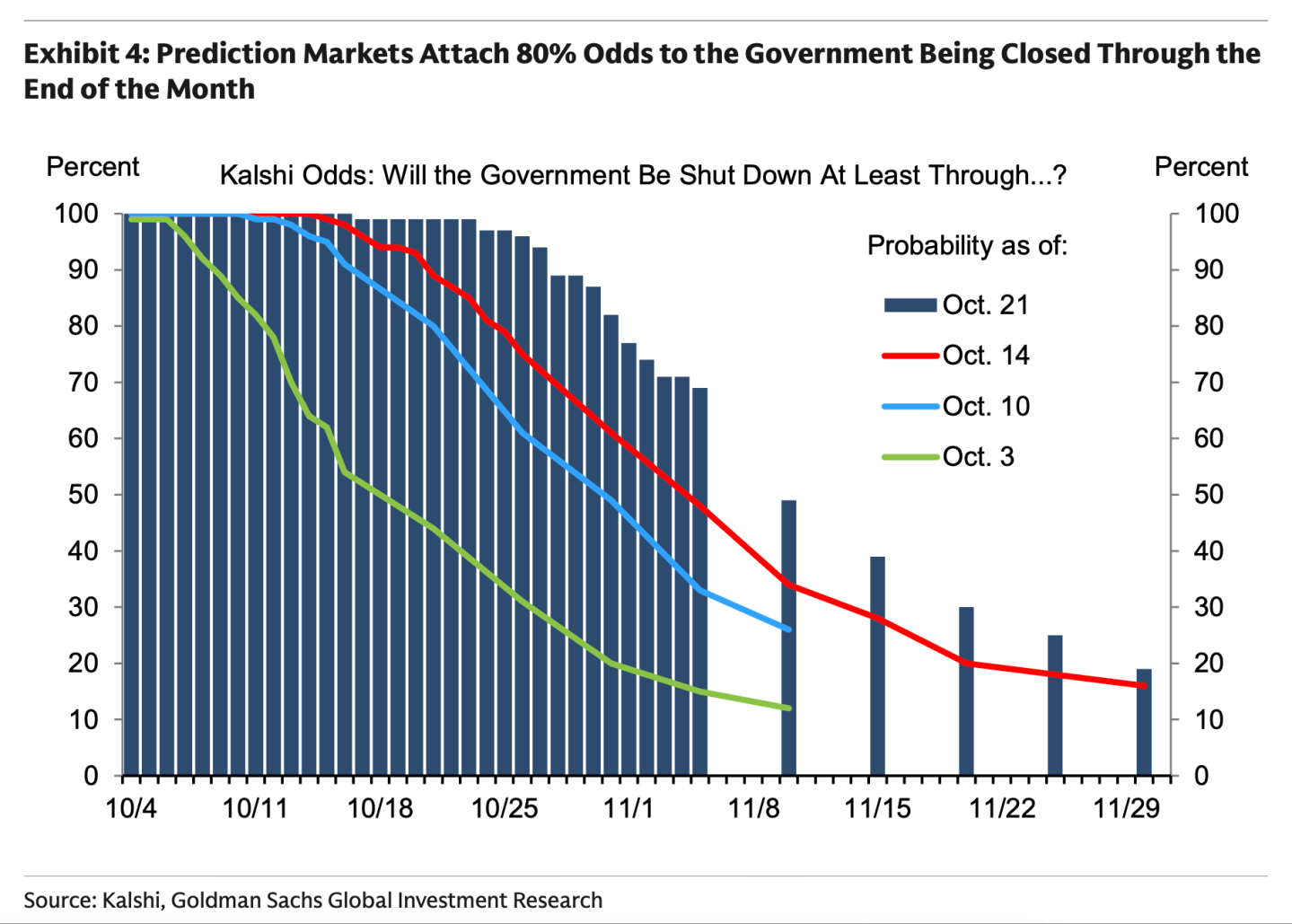

One attention-grabbing side of that is that the continuing U.S. authorities shutdown will possible forestall Bureau of Labor Statistics from gathering the October information on employment and inflation, in keeping with Ronnie Walker and his colleagues at Goldman Sachs.

That will imply traders are at the moment flying blind in terms of high-quality macroeconomic information—and they seem like having fun with the view.

“The gathering and launch of practically all federal financial information is postponed till after the federal government shutdown ends. The potential influence of the shutdown on the standard and availability of the October employment report and CPI relies on what information might be collected retroactively,” Walker wrote in a be aware to shoppers.

“The shutdown seems most problematic for the standard of the CPI. Whereas the usage of different information implies that costs might be collected retroactively for collection that make up 10-20% of the basket, the overwhelming majority of CPI worth quotes are collected by hand and are collected roughly evenly throughout the calendar month,” he mentioned.

Among the many BLS’s choices can be to try to gather the info retroactively, to estimate the info, or to easily go away a gap within the information—which might have an effect on economists’ potential to accurately calculate averages for a spread of information collection.

Non-public information surveys aren’t nearly as good, in keeping with Samuel Tombs and Oliver Allen at Pantheon Macroeconomics: “The absence of official information through the federal authorities shutdown is shining a brighter highlight on the month-to-month enterprise and client surveys. A few of these surveys include indicators that are effectively correlated with the official information on employment, costs, wages and capex, however they typically fall down as guides to GDP.”

Within the absence of information that may throw chilly water on the get together happening in shares proper now, Q3 earnings stories are prone to carry shares additional.

Dubravko Lakos-Bujas and his staff at JPMorgan estimate that the S&P 500 earninugs will develop by 12% as soon as all corporations have reported. “U.S. corporations ought to proceed to ship superior earnings progress supported by a sturdy AI funding cycle, ongoing deficit spending, and a nonetheless resilient client. We anticipate S&P 500 will ship one other quarter of double-digit earnings progress (~12%), pushed by above-trend progress from the AI 30 corporations (3Q25 consensus: 14%) and rebounding progress for S&P 470 (3Q25 consensus at ~4% vs. 2024 at -0.4%).”

Right here’s a snapshot of the markets forward of the opening bell in New York this morning:

- S&P 500 futures have been up 0.11% this morning. The index closed flat in its final session.

- STOXX Europe 600 was flat in early buying and selling.

- The U.Ok.’s FTSE 100 was up 0.83% in early buying and selling.

- Japan’s Nikkei 225 was flat.

- China’s CSI 300 was down 0.33%.

- The South Korea KOSPI was up 1.56%.

- India’s Nifty 50 was flat earlier than the top of the session.

- Bitcoin was flat at $108K.